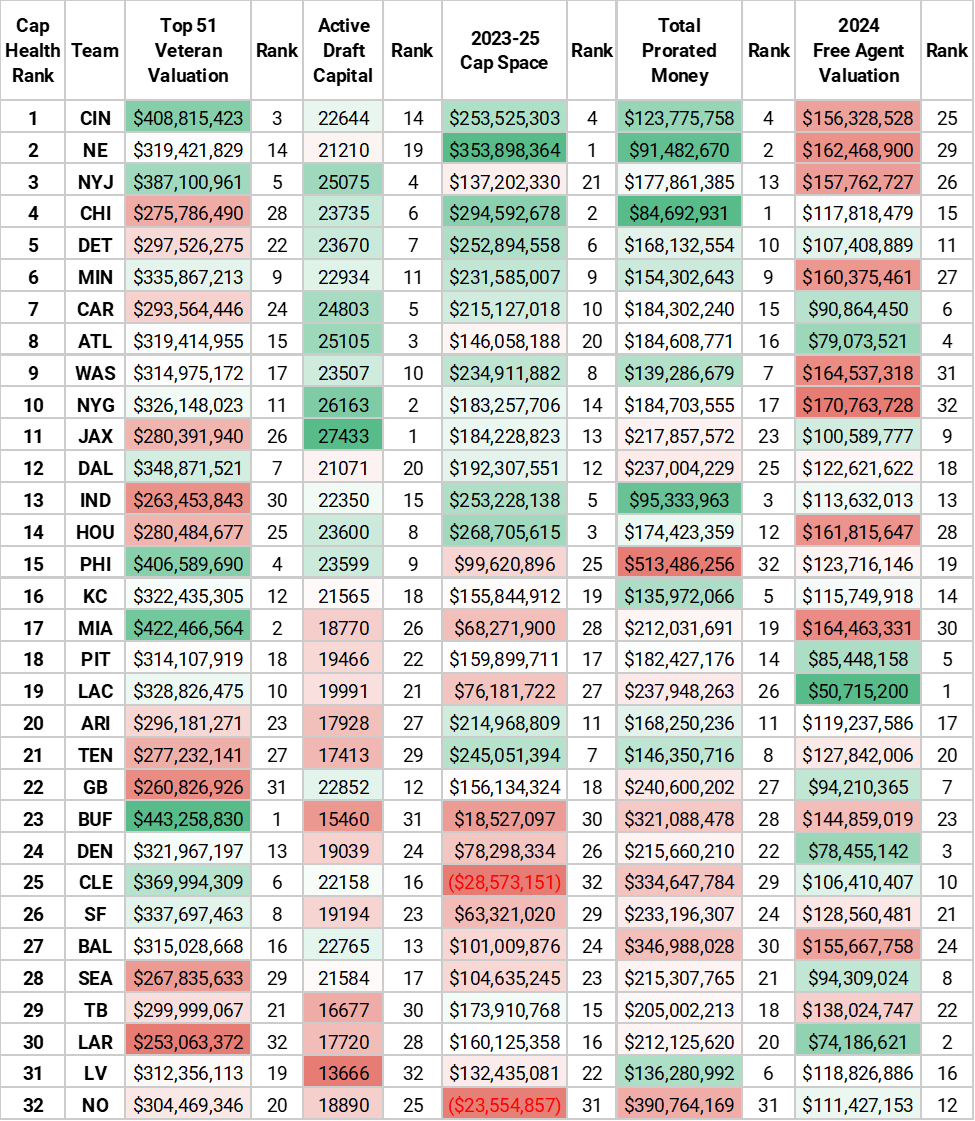

• Bengals rank first in cap health for second year in a row: The Bengals have done well to add talent in the draft as mega contract extensions loom for their top players.

• A Lions franchise on the rise cracks the top five: Detroit ranks in the top 10 in 2023-25 cap space and the bottom 10 in total prorated money, with not many major internal extensions pending.

• Saints continue to work through salary cap struggles: The fourth-oldest roster in the NFL ranks 20th in our top 51 veteran valuation, and the team ranks 31st in 2023-25 cap space and total prorated money.

Estimated Reading Time: 24 mins

Each NFL offseason brings with it a wave of player movement across the league, especially now, in a new era of roster construction. Blockbuster trades at premium positions — for years an extreme rarity — have seemingly become the norm. Teams are more honest with themselves about the talent on their roster or lack thereof. For example, the Detroit Lions moved on from quarterback Matthew Stafford as opposed to chasing mediocrity and prolonging their inevitable rebuild.

At the same time, other teams close to reaching the mountaintop but held back by a few deficiencies — such as the Los Angeles Rams with quarterback Jared Goff — are willing to be more aggressive in the pursuit of a Super Bowl title. These two forces operating in tandem will lead to major swings in roster construction and, thus, salary cap outlooks from season to season, but likely for the better for all parties involved. In theory, each team is choosing the fastest path to building a legitimate contender, just in opposite ways.

We discussed our updated methodology in last year’s article, but as a refresher, here are the two main adjustments:

First, instead of just ranking each team in each of our five categories (explanations below) and then taking the average of the five rankings, we’re using z-scores to capture just how far from the league average each team deviates in each category.

Second, we’ve weighted each category to better reflect their importance in salary cap/roster construction health. Most importantly, having a strong Top 51 Veteran Valuation matters more. After all, having a ton of salary cap space is of no use if a roster lacks talent. Some of the league’s better teams still find themselves at the bottom of the list, which will understandably lead to criticism, but at the end of the day we are still attempting to capture salary cap health first and foremost.

All contract data is updated with official contract figures as of July 4.

Criteria

Top 51 Veteran Valuation:

This is the total valuation of all players on each club’s top 51, excluding 2023 draft picks. This is a snapshot of their current value under 2023 market conditions, not a forecast of what they would theoretically cost on the open market after the season.

During the offseason, to enable clubs to carry 90-man rosters, only the 51 largest cap hits count against their salary cap. Thus, we have taken each team’s current top 51 cap-hit players, removed rookies and calculated their total value.

Looking at the 2022 rankings for veteran valuation, six of the top 10 teams made the playoffs and three of the bottom 10 teams made the playoffs.

Rookie-contract players (“Active Draft Capital”):

We converted every rookie-contract player currently on each team’s roster into their Fitzgerald-Spielberger value in the same manner Timo Riske analyzed each team’s 2021 Draft capital to weight each player's value. For example, No. 1 overall pick Carolina Panthers quarterback Bryce Young would be worth 3,000 points on this scale. The Panthers have the fifth-largest draft capital investment on their roster currently.

This aims to capture both the value of players who have not played an NFL snap yet, such as Young, as well as the total potential for surplus value each team has from rookie contracts. The NFL rookie wage scale made draft picks more valuable than ever before, because not only are you adding quality young talent but you also realize significant savings as compared to the veteran player market. Thus, there is a clear connection to forward-looking cap space here, especially in a three-year window.

Projected effective cap space 2023-2025:

We’re using a projected salary cap of $256 million in 2024 and $282 million in 2025, as seen on OverTheCap.com, which are undoubtedly bullish figures.

We use “effective” cap space to examine future years because not every club has at least 53 players under contract in 2024 and 2025. The calculation for effective cap space is simple, and while it will still not capture the true future outlook, it provides a solid framework to work from. Example:

Team X has 45 players under contract in 2024 and $20 million in cap space. The minimum salary for a player in 2024 is $795,000. In order to field a full 53-man roster, Team X must sign eight more players with cap hits of at least $795,000 in 2023.

- 8 x $795,000 = $6,360,000

- Team X really has at most $20,000,000 – $6,360,000 = $13,640,000 in 2024 cap space

- Team X has $13,640,000 in effective 2024 cap space

Total prorated money (including money that will void):

When money is converted into a bonus that prorates over a number of years — most typically signing bonuses — it can no longer be manipulated for salary cap purposes. These amounts are truly sunk costs on the salary cap, unlike guaranteed salaries that are effectively sunk cash amounts but could still be altered from a cap accounting perspective.

Teams have to work around these sunk costs even after a player is no longer on their roster, when they become what is referred to as “dead cap.” The existence of some dead money is fine; if anything, it suggests a club’s willingness to spend cash and be more aggressive in their roster construction from time to time. However, a significant amount of dead money will inhibit a team’s ability to effectively add talent.

2023 free agent projections (“2023 UFA Valuation”):

The contract or “platform” year for a pending unrestricted free agent is undoubtedly the most important year for projecting what they will earn in free agency. Here, we are not attempting to forecast the 2023 performance of pending 2024 free agents and then calculate a valuation for that player. Thus, these values are certainly subject to change; however, we also often do have a relatively strong understanding of a player’s value before their final season on their current contract.

For example, Dallas Cowboys quarterback Dak Prescott and New York Giants wide receiver Kenny Golladay missed the majority of the 2020 season and still signed the largest free-agent contracts at their respective positions in the 2022 offseason.

On the other hand, we are predicting the growth in position markets year-to-year and inflating our contract projections in accordance with these rough expectations.

JUMP TO A TEAM:

ARZ | ATL | BLT | BUF | CAR | CIN | CHI | CLE | DEN | DAL | DET | GB | HOU | IND | JAX | KC | LVR | LAC | LAR | MIA | MIN | NE | NO | NYG | NYJ | PHI | PIT | SF | SEA | TB | TEN | WSH

Arizona Cardinals — Rank: 20

The Cardinals have effectively hit the reset button and are ushering in a new era under general manager Monti Ossenfort and head coach Jonathan Gannon. Arizona didn’t retain any of its top free agents, including interior defender Zach Allen and cornerback Byron Murphy Jr., and eventually made the tough decision to release wide receiver DeAndre Hopkins. Wide receiver Marquise Brown is a pending free agent and the next big decision facing the franchise, but the team is clearly focused on 2024 and beyond.

Atlanta Falcons — Rank: 8

The Falcons were near the top of the NFL with more than $63 million in dead cap for 2022. Former quarterback Matt Ryan and wide receiver Julio Jones accounted for more than $56 million of that. A quick teardown landed Atlanta with extra draft capital over the past two years and cash to burn this offseason, and now they find themselves in the top 10 with starting quarterback Desmond Ridder on a third-round contract and an overhauled defense that boosted the team's top 51 veteran valuation without totally breaking the bank.

Get the 2023 Fantasy Draft Kit for FREE

with annual planAlready have a subscription? Log In